The Rising Concern of Cross-Border Transactions

We all live in the global finance era, and transferring money across borders has become routine. Yet, beneath this convenience lies hidden charges that can significantly change the ultimate cost of these transactions.

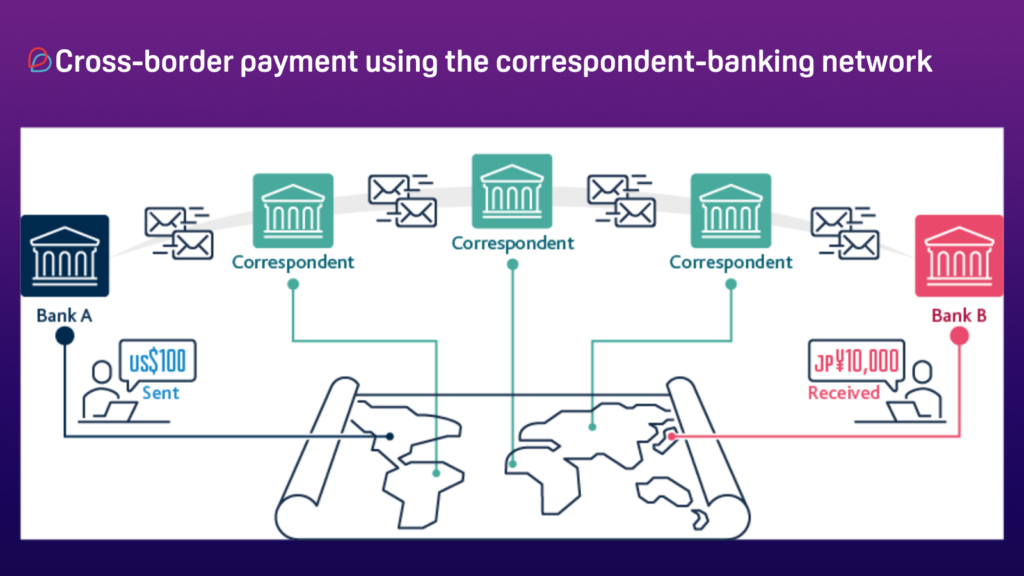

The process of moving money internationally via traditional means usually encompasses several forms of charges, such as:

- Foreign Exchange Fees: When one currency is swapped for another, an additional charge occurs. These fees, combined with the fluctuating exchange rates, can often lead to higher transaction costs than initially anticipated.

- Third-Party Charges: A network of financial institutions frequently facilitates global transactions. Each participant may apply a fee, contributing to the cumulative cost of the transfer.

- Processing Fees: These charges, either fixed or a percentage of the transaction value, are imposed to cover the operational costs when handling international transactions.

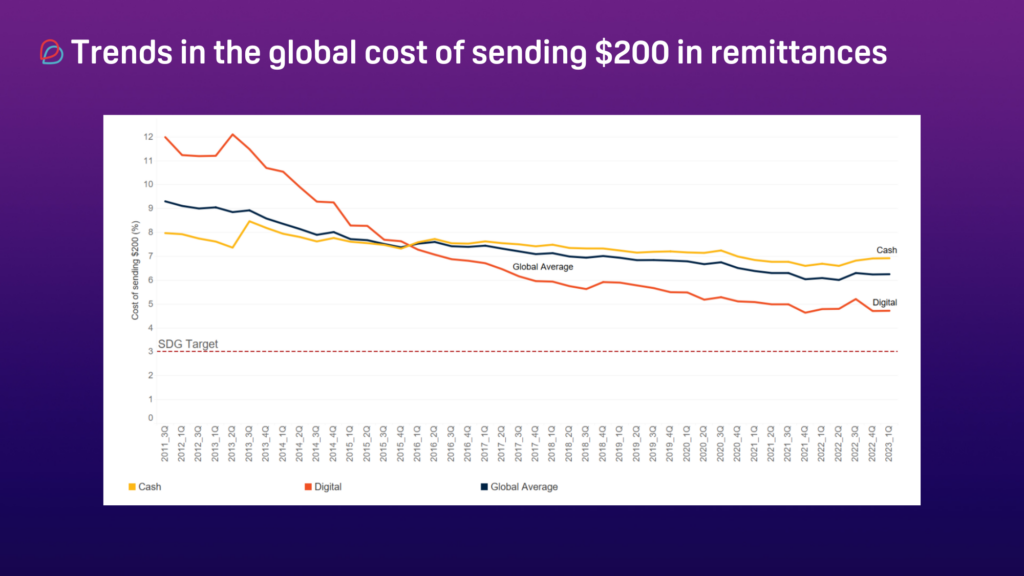

A recent report by World Bank indicates the average global cost of transferring $200 is a startling 6.25% in Q1 of 2023. These costs can significantly reduce the value of the transaction, impacting not only individuals but also businesses engaged in global commerce.

The Hurdles Faced by Regular Travellers and Digital Nomads

For those who travel often or embrace a digital nomad lifestyle, global transactions are a daily reality. Unfortunately, the associated hidden fees can eat away at their financial resources, influencing their travel budgets and overall standard of living.

Imagine the scenario of a digital nomad residing in an idyllic location such as Bali, Indonesia, while working for an employer based in the United States. Each payday would involve converting dollars into Rupiah, which would attract foreign exchange and possibly intermediary fees, thereby shrinking the final pay received. In addition, if this nomad uses an international ATM to access cash, additional processing charges apply.

Likewise, a frequent traveller utilising a home-country-issued credit card to pay for a hotel stay overseas will end up paying more than just the converted amount. Credit card providers add international transaction charges, which are usually small, but can quickly pile up throughout a trip, not to mention there is no way to track these fees, anywhere.

These hidden charges, ingrained in traditional international transactions, pose a considerable financial challenge. With the surge in digital nomads and international travel, the call for more streamlined and affordable global payment solutions grows louder. Crypto remittance services offer a revolutionising alternative, redefining the paradigm of global payments.

Introducing Crypto & Stablecoins Remittances

Cross-border transactions are expected to jump from $150 trillion in 2017 to more than $250 trillion by 2027. So, as the financial landscape evolves, crypto and stablecoins remittances emerge. This technology has revolutionised the way we transfer funds across borders, providing a clear alternative to traditional banking systems (see Figure 3 above).

Imagine BABB now, which offers a unique solution. Currency X is a basket of stablecoins facilitating seamless peer-to-peer transfers and exchanges. It enables conversions between fiat currencies and stablecoins, with each stablecoin pegged to its corresponding fiat currency, thereby simplifying cross-border transactions. BABB’s crypto offerings also make a difference in the remittance landscape by allowing efficient global transfers with the BAX token, anywhere around the world while also facilitating conversions to stablecoins with minimal fees and most importantly, no hidden charges or fees.

The advantages of crypto and stablecoins remittances are substantial. They offer faster transaction times, significantly reducing the processing period compared to traditional banking systems. The lower fees, a product of bypassing expensive intermediaries, also make these remittances a cost-effective solution. Furthermore, the inherent transparency of blockchain technology makes every transaction trackable and auditable, a feature absent in traditional systems.

On-chain Fiat Remittance: The ReDeFi Project

Moving into a realm of even greater innovation, we come across on-chain fiat remittances. Thus, we are proud to briefly introduce ReDeFi (Regulated Decentralised Finance), a Financial Conduct Authority (FCA) registered firm based in the UK, that brings the mirroring of real bank accounts on the blockchain.

In essence, this technology digitises fiat money into an on-chain equivalent, enabling direct and transparent transactions. It’s as if your traditional bank account suddenly acquires superpowers, eliminating hidden fees and cutting down the high costs associated with remittances.

Blockchain technology streamlines cross-border transactions, reducing unnecessary fees. It takes away the need for intermediaries—banks, and payment correspondents—who often complicate transactions and increase costs. By creating a direct peer-to-peer network, blockchain eliminates these middlemen, thus reducing transaction costs and increasing speed and efficiency.

In a nutshell, these advancements—crypto, stablecoins and on-chain fiat remittances—are a testament to the technological evolution of financial transactions. They pave the way for faster, cheaper, and more transparent global transfers, providing viable alternatives to traditional banking systems. BABB paves the way signifying an exciting chapter in our journey towards financial inclusion and democratisation.

BABB – Bridging the Gap in Cross-Border Payments

Yet again, we are reshaping the landscape of cross-border payments with our new features. By merging blockchain technology and on-chain crypto and fiat remittance solutions, we want to ensure faster, more secure and affordable transfers, which were previously dominated by traditional banking methods. Our commitment to financial inclusion sets us apart, with an ambition to provide banking services for everyone, irrespective of their location or background. We believe that cross-border payments shouldn’t be a luxury, so we are paving the way for a more inclusive global financial ecosystem.

Don’t miss out on this opportunity to be part of our mission for financial inclusion, where banking services are accessible to everyone, regardless of their location or background. Join the BABB app now and start benefiting from low-cost, faster, and more secure cross-border payments!

Interested to learn more about BABB and BAX? 📣

Join our BABB community on Discord and Telegram, and stay in the loop with the latest news. You can also follow us on our Twitter and Facebook to stay up-to-date.

____________________________________

Disclaimer: Stablecoins are a type of Digital Currency or Cryptocurrency that are pegged to a reference asset, oftentimes an official currency such as the Pound Sterling or the US Dollar, but it can also be referenced to other assets or financial instruments. As such, Stablecoins pose a risk of de-pegging which may lead to a permanent capital loss. Stablecoin and Cryptocurrency services are not currently regulated by the Financial Conduct Authority or any other regulator in the UK. However, Stablecoin and Cryptocurrency service providers in the UK are required to register with the Financial Conduct Authority for Anti-Money Laundering and conduct purposes. ‘BABB Remit Ltd’ and ‘Regulated Decentralised Finance Ltd’ are both registered with the Financial Conduct Authority. You should carefully consider whether trading or holding digital currencies or cryptocurrencies is suitable for you in light of your own financial situation and attitude to risk, as evaluated by you carefully.