How BABB App Is Making Financial Inclusion A Reality By Bridging The Gap Between Banking and Crypto

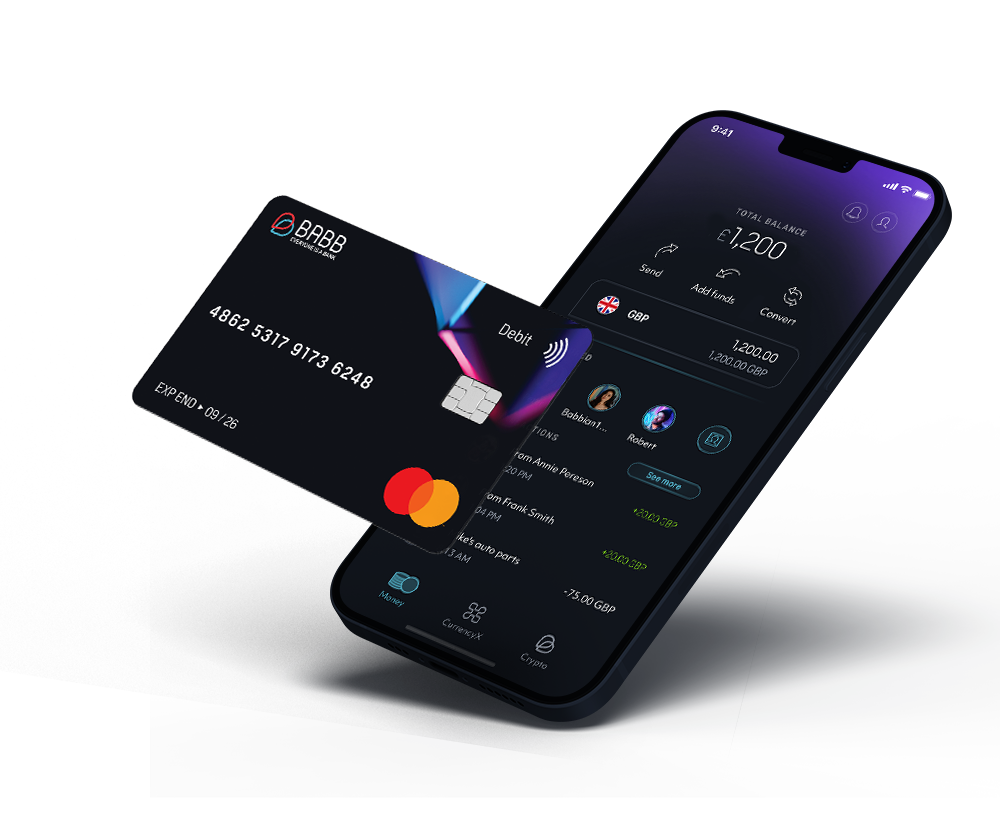

Are you looking for a centralised system that will assist you in keeping track of numerous cryptocurrencies, as well as fiat currency and stablecoins? In the blog post, we will examine the BABB App and everything it has to offer, from its hybrid Great British Pound account and virtual cards to its three core areas (Money, CurrencyX, and Crypto).

Individuals now have access to cutting-edge features that make it simpler and easier for them to handle their financial affairs thanks to BABB App. The app makes it easy and convenient for you to keep track of and record your day-to-day financial dealings by including a tab titled “Money” in its interface. The application gives you a centralised location from which you can examine the current balance in your account, make payments, keep tabs on your expenses, and manage your finances in general. Thanks to its user-friendly interface, it makes it simple enough for anyone to use the app, including people who are not particularly knowledgeable about technology.

The “Money” Section

The “Money” tab provides access to a comprehensive set of functionalities, such as day-to-day banking, the ability to pay and get paid in fiat, the receipt of wages, the establishment of direct debits (soon to come), the conversion of fiat to currency, and even the capability to withdraw money and make payments anywhere. In addition, the Babb app users will be able to obtain both virtual and physical cards, enabling them to access their money regardless of where they are in the world.

The “CurrencyX” Section

It is a cutting-edge feature that gives customers access to a multicurrencyX account, making it simple for them to send and receive money in different countries worldwide. Users can engage in free peer-to-peer (P2P) transactions with other BABB users, convert between GBPx, EURx, and USDx, and even convert CurrencyX to BAX, BTC, and ETH. In addition, the Babb app allows users to transfer CurrencyX to fiat money, making it a suitable instrument for anyone looking to send money to a country with a different currency.

The CurrencyX function is especially beneficial for individuals who have a consistent requirement to send money to a foreign country, it acts also as an intermediate between the fiat money and the cryptocurrencies.

The “Crypto” Section

The Crypto tab is one more feature that sets BABB App apart from other apps. Users who take advantage of this feature can access a free cryptocurrency wallet that supports the top cryptocurrencies. These cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), BAX, USDT, as well as other cryptocurrencies that will be added to the Babb platform.

The app gives users the ability to store their Bitcoin in a wallet, convert it into other currencies, stablecoins, or fiat money, and send it to other wallets or loved ones. In addition, the app enables users to withdraw funds to and from external wallets and send and receive funds free of charge to and from other BABB users.

People can have access to fundamental financial services much more quickly and easily thanks to the BABB platform, which is one of the major advantages of utilising the app. The application’s purpose is to serve humanity’s needs, and it acts as a connection between the conventional banking system and the cryptocurrency sector. By giving users access to fundamental and basic financial services and enabling them to send and receive money for free in any part of the world, the Babb platform works to expand people’s opportunities to participate in the global financial system.

To summarise, the BABB App is a fantastic resource for anyone who wants to be in charge of managing their finances. The Money, CurrencyX, and Crypto tabs provide customers with a wide range of services that simplify the process of monitoring their personal finances, sending and receiving money across international borders, and even gaining access to cryptocurrencies. The Babb app is a game-changer for anyone who is interested in managing their finances in a way that is both more efficient and more secure.

In the world of financial technology, BABB is not your typical financial service platform. By bridging the traditional financial system and the cryptocurrency industry, our mission is to make the world a better place. We believe that everyone, regardless of where they live or how much money they have, ought to have access to essential banking services, regardless of their financial status. Because of this, we are campaigning for universal access to financial services and supplying individuals who do not have bank accounts with options for making affordable international money transfers.

Our app is designed to be user-friendly and uncomplicated in every way possible. Our program will make it much simpler for you to manage your financial resources, regardless of whether you are an experienced crypto trader or just beginning your journey in finance. Our app can handle fiat currency, stablecoins, as well as cryptocurrencies, so there is no need to hop between multiple apps or platforms. (how cool is that?)

Our software brings together the streamlined experience of traditional banking with the decentralised nature of cryptocurrency. Join us on our journey and discover everything the BABB App has in store for you!

Want to try the new Hybrid Account? Download the Babb App

About Babb

Babb is an FCA-registered company based in London, operating in the financial technology industry. The company was founded by Rushd Averroes in 2016 and focuses on decentralized banking systems offering peer-to-peer money and crypto transfer, mobile banking app, money accounts, and cards…

For more information, view the website here: https://getbabb.com

Disclaimer: Cryptocurrency services are not currently regulated by the Financial Conduct Authority or any other regulator in the UK. You should carefully consider whether trading or holding digital currencies or cryptocurrencies is suitable for you in light of your own financial situation and attitude to risk, as evaluated by you carefully. We do not make any representations or recommendations regarding the advisability or otherwise of trading in digital currencies and cryptocurrencies or any particular transaction.